On Bitcoin Elasticity and Use as a Medium of Exchange

Later this morning, I will be joining Mark Moss on his podcast to discuss these topics with he and Jeff Snider live at 10am CT (see link).

The discussion was prompted by a comment I had made last week regarding a short video of Jeff discussing his view that bitcoin is flawed as money and not useful as a medium of exchange because it is not elastic in supply (see link).

While I do not know Jeff personally, I owe him a debt of gratitude. Eight years ago, I came across his writing (in 2016) about the Federal Reserve and quantitative easing. Jeff had read a whole series of Fed meeting transcripts (which are released five years after meetings) and whether he expressly recommended the exercise to his readers, it prompted me to do the same. It was eye opening. It led me to the conclusions that: i) the Fed governors and presidents are consistently wrong in an objective and historical sense; ii) the Fed does not have any material understanding of how its money printing impacts the real economy, in a direct sense; iii) that the Fed is always going to have to print more money until it no longer can and iv) this is all highly problematic to economic stability.

It ultimately led me to bitcoin. So while Jeff and I disagree on bitcoin today and on some fundamental economic principles, I have a great deal of respect and appreciation for him. In advance of our discussion, I wanted to organize and share my position on bitcoin's elasticity and viability as a medium of exchange.

TLDR: Bitcoin has a perfectly inelastic total nominal supply of 21 million but its available supply–which is most relevant to the needs of the market–is perfectly elastic. Bitcoin will emerge as the global reserve currency, the global unit of account and global medium of exchange because of its fixed supply, not despite it. All the while, 100% of its supply will remain available and be perfectly elastic to the needs of the market at any point in time.

On Bitcoin Elasticity and Use as a Medium of Exchange

Definitionally from a general economic standpoint, elasticity of supply is a measure of how responsive the supply of a good or service is to changes in its market price–how responsive supply is to increasing demand.

First, it would be an error to believe or expect that supply response–supply elasticity–in the market for any long-term asset would come only from new units. Maybe with the exception of perishable goods or one-time use goods, supply response always comes from a combination of new units and existing units in all markets. This is true of cars, houses or any long-term asset including money. Supply elasticity of cars is in part determined by the availability of used cars as well as new cars. The supply elasticity of homes is in part determined by the resale of existing homes (or second homes) in addition to new builds.

So accept that supply response and supply elasticity in response to price naturally comes at least in part from existing units in practice rather than in economic theory (i.e., some of a goods elasticity does come from in-place supply). Now, what defines a good form of money (or a sound money) is that the majority of supply response comes from existing units rather than new units. A form of money that is easy to print–where an increase in price driven by an increase in demand can be easily met with someone printing more new units–is an inherently bad form of money. The supply constraint of a sound money is: i) what dictates that supply elasticity comes from existing units and ii) what allows money to store value–so it is actually a requirement to money being money.

With bitcoin, 100% of the supply response or supply elasticity comes from existing units. It has to because it has a fixed supply. So while bitcoin’s total nominal supply is perfectly inelastic, it has a perfectly elastic available supply at the same time. What differentiates money, including bitcoin, is that 100% of units are functionally available at any point in time to trade. Money is useful to store value and facilitate exchange. This is what differentiates money from consumer goods and capital goods from a value or utility standpoint, which are all in some way consumed.

Furthermore, cars, houses, couches, etc., have to be produced in order to be supplied to the market and you can’t trade half a car, house, or a couch, practically speaking. In contrast, you don’t have to produce money because it already exists as savings, and it’s there for the express purpose of exchange. And you can trade or exchange some of your money without impacting the value of your remaining savings. That is the value of money. The money is always there and available. If the market needs more money, the prices of goods just have to fall to such a level to induce a supply response from existing holders of the currency. Price or purchasing power induces the supply elasticity of a good money, such as bitcoin.

So when anyone claims that bitcoin is not elastic enough, what does that really mean? It means supply is not responding “fast” enough or to a “sufficient” degree in quantity–both of which are inherently subjective in someone’s opinion–but importantly, it implies that what’s really important is speed (or timing) and quantity of response in a given time interval, regardless of where it comes from. Given that time interval, speed and total quantity is inherent to this line of thinking, the ability to expand total nominal supply is less relevant than the ability for marginal supply to respond and be flexible. It also implies the desire to have a central authority or issuer to be in a position (and able) to respond rather than the market of existing currency holders–to influence speed and timing.

So it’s not really about aggregate elasticity at all. It is about who responds, how and when–a central bank or the market. The market for bitcoin is perfectly elastic fundamentally for the reason that 100% of its existing supply is always available. If you want a centralized third-party to participate in its supply response function, you would just have to create a reserve or rainy day fund and fund it with actual bitcoin likely via taxes–rather than how the Fed does it today by creating money out of thin air. But what makes more sense? Having a system in which 12 people (i.e., the Fed governors and presidents) influence supply response or the entire market–say 100 million people or in the future, 8 billion.

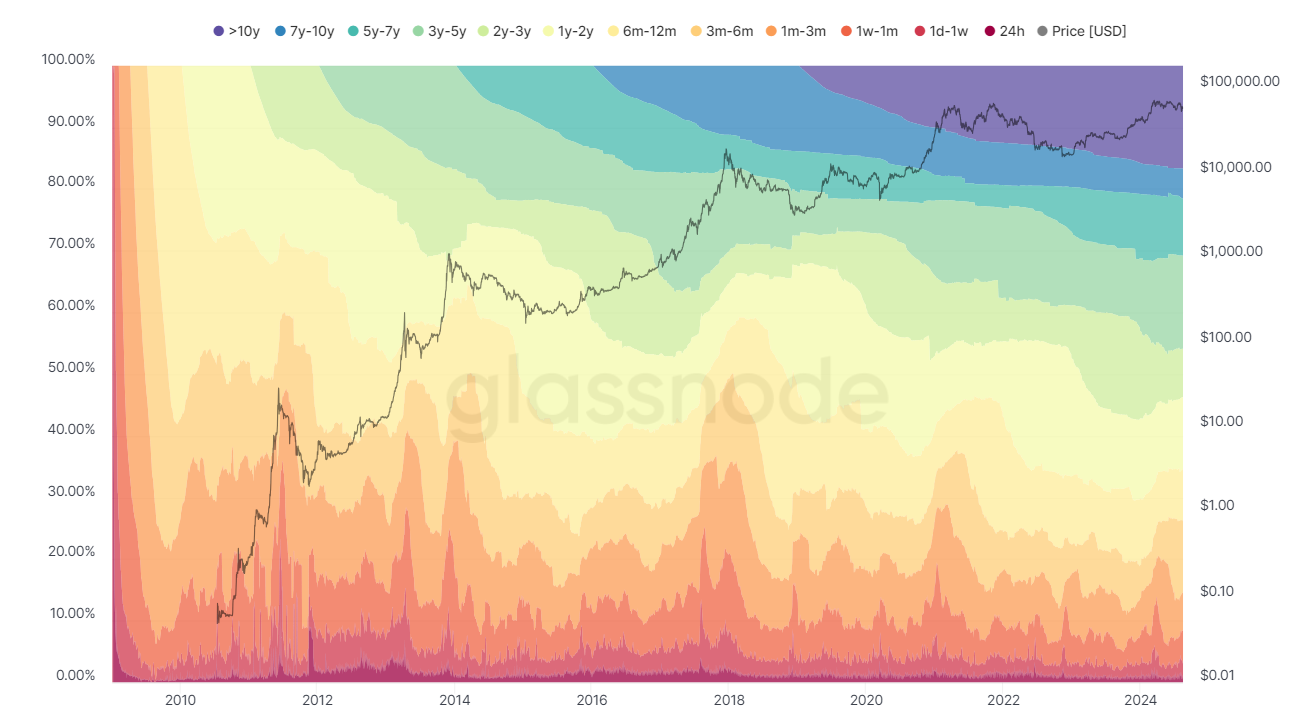

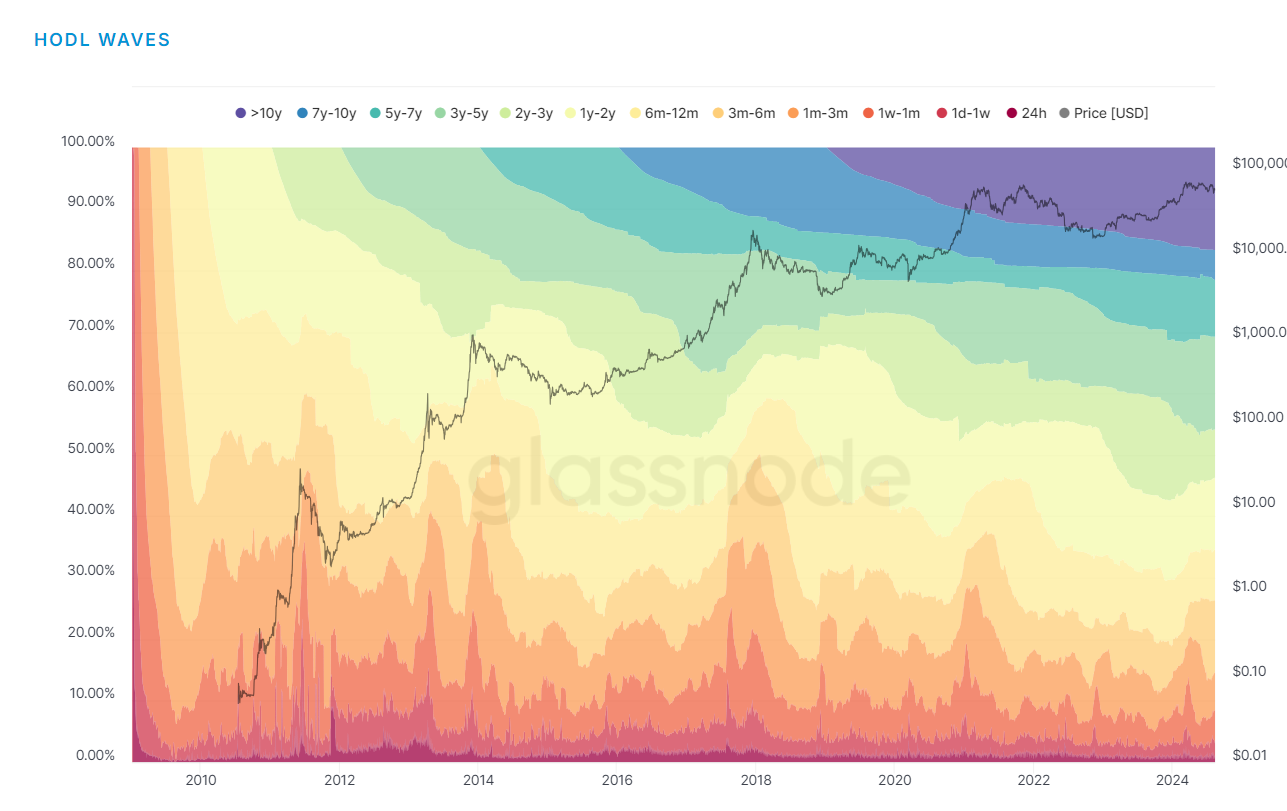

In practice, the actual market for bitcoin demonstrates two facts: it has a perfectly fixed supply. No more than 21 million bitcoin can exist AND the available supply of bitcoin is perfectly elastic to respond to increasing demand and price at any point in time. In 2017, bitcoin increased by 20x and 20% of the available supply responded to the increase in price–or 3 million bitcoin. Earlier this year, bitcoin nearly doubled in value and 5% of bitcoin transferred from long-term holdings to meet new demand, this represented about 1 million bitcoin.

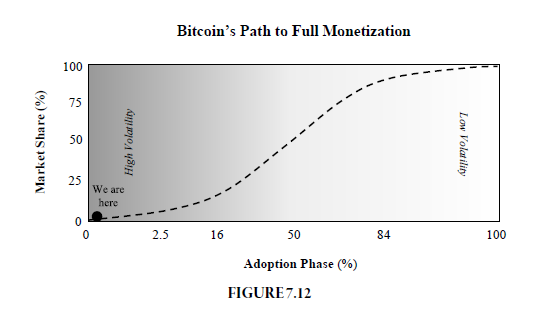

Now, beyond the question of whether bitcoin’s supply is elastic–which it is–the further substance of the criticism is that bitcoin is not sufficiently elastic to be adopted as a medium of exchange. But despite the perception, adoption continues to grow. Despite any debate over its real or theorized elasticity, despite its volatility and despite its fixed supply, bitcoin adoption continues to grow. In reality, bitcoin adoption continues to grow because of its fixed supply, not despite its fixed supply. That is the foundation of bitcoin’s ability to store value and a good’s ability to store value dictates over the long-term whether it will be used as a medium of exchange.

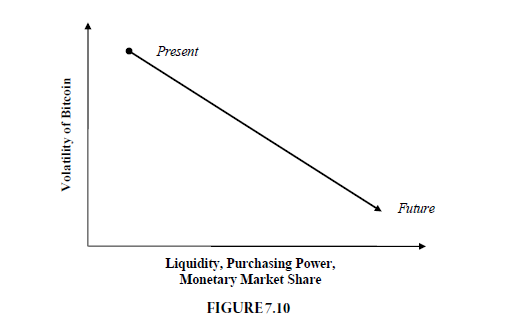

The debate as to whether bitcoin will be used as a medium of exchange really has nothing to do with elasticity, despite the claim that it does. Instead, it has everything to do with stability of price or volatility. Stability in the price or value of bitcoin will come from increased adoption. Stability is an emergent property of adoption–specifically mass adoption. Stability will emerge when sufficient people adopt bitcoin–when incremental adoption can only represent a fraction of existing (or in-place) demand rather than multiples or orders of magnitude. Simplistically, think about that in terms of when more than 50% of the world has adopted bitcoin or when greater than 50% of the global demand to store value in money has adopted bitcoin.

Praxeologically, bitcoin is already being used as a medium of exchange for those storing value in it. Bitcoin is the medium, and it is effectively bridging past or present exchange(s) to a series of future exchanges today. Practically, everyone in the world is going to demand bitcoin as a store of value because of its fixed supply and when a critical mass is reached, it will be adopted rapidly as a medium of exchange in direct commerce for goods and services. Bitcoin’s fixed supply is the causal link that drives adoption. So ironically (or not), its perceived inelasticity is what will cause bitcoin to be used as an everyday medium of exchange.

Bitcoin is adopted as knowledge distributes and knowledge distributes, in an accelerating way, as a function of time. Often the hardest aspect of bitcoin to get one’s head around is that bitcoin has historically and objectively been an exceptional store of value despite its volatility. It’s an exceptional store of value because of its fixed supply and it’s also volatile for the reason that its available supply is highly elastic in response to rapid changes in price or value. As mass adoption occurs, bitcoin’s value will become stable, but bitcoin’s (available) supply will remain perfectly elastic at the same time, one hundred percent of it.

When the entire world has adopted bitcoin, it will be the unit of account. That is the end game of stability in the value of bitcoin. Virtually all goods and services will be priced in bitcoin and trade will be settled in bitcoin. At this future point of full adoption, global demand will be in steady state and any rise or fall in demand for money (bitcoin) will by definition be marginal. When practically 100% of people have adopted bitcoin, any incremental demand could only represent a small fraction. Said another way, so much value will already be stored in bitcoin when the entire world has adopted it as money, that any periodic rise in demand would require only a small marginal nominal amount of the currency relative to the total available supply to be satisfied.

This is fundamentally why (and how) bitcoin will be both stable in value and elastic to the needs of the market without impacting stability. But of course, none of it happens by chance. It is all dictated because bitcoin’s total nominal supply is perfectly inelastic. That drives everything.

To learn more, checkout my book: Gradually, Then Suddenly. You can find a free online version here at the Satoshi Nakamoto Institute (recommend reading Chapter Seven: Bitcoin is Not Too Volatile) and you can purchase a copy of the hardcover at TheSaifHouse.com