Abundance-Through-Scarcity Paradox

In the Bitcoin Times Energy Edition, Gideon Powell wrote about the cultural importance of having an abundance mindset–which was contrasted to a scarcity mindset. Gideon's piece, “Bitcoin, Energy, and Human Ingenuity”, struck a chord for me and got me to thinking more about the relationship between abundance and scarcity.

An abundance mindset, simply put, is anchored to the idea that resources are abundant. There are more resources available in this world to satisfy all the possible wants of everyone on earth. What is limited is human time and the human ingenuity necessary to harness or refine otherwise abundant resources–to make them consumable and useful to humans. However, the abundance mindset is critical to making resources that are available but not yet utilized functionally abundant. The mindset itself is the most important input to expanding the pool of resources that can actually be tapped.

If you look at the world with a scarcity mindset, you inherently fixate on redistributing resources that are currently available–like a fixed pie–rather than expanding the scope of available resources. Made worse, it is not a static equilibrium. A scarcity mindset actually creates more scarcity. It reduces the pool of available resources, creating greater scarcity of tangible goods and services. The fixed pie actually becomes smaller with a redistributionist mentality. The scarcity mindset takes for granted that any current level of comfort (or wealth) was only made possible by people who approached the world with an abundance mindset–those who set out to make resources more abundant than in any prior state.

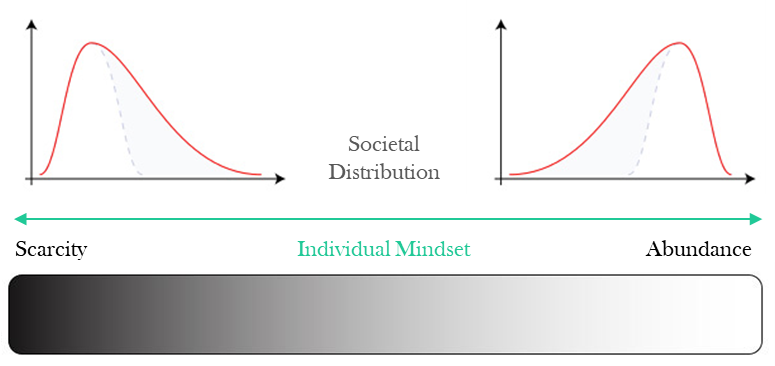

To oversimplify, think about the population as a distribution of individuals either with an abundance mindset or a scarcity mindset–accepting in reality there is room for gray. As more people shift to having an abundance mindset, more resources are tapped and greater abundance is created. The opposite is also true. If more people shift to having a scarcity mindset, more focus is placed on redistribution and less is actually produced.

For any individual, time is finitely scarce. Energy can either be devoted to producing greater abundance or extracting wealth from those who do. Any time spent with a scarcity mindset inevitably detracts from one’s ability to contribute to an endeavor creating greater abundance. Accept that all mutually beneficial value originates from those with an abundance mindset–even when taking into account the valuable function of charity or the forced redistribution of wealth by those who operate with a scarcity mindset. Value must first exist–resources must first be refined into some greater utility–for there to be anything to then be distributed or redistributed.

As Elon Musk concisely put it in the middle of the 2020 government lockdown, “Now let me just break it to the fools out there. If you don’t make stuff, there is no stuff.” The short video linked is worth watching. It’s so simple but despite the simplicity of the principle, it’s not so obvious to a lot of people. The more substantive point is that all stuff comes from individuals who approach the world with an abundance mindset.

The abundance mindset naturally exists within all producers, consciously or subconsciously. It is fundamental to anyone who taps an otherwise unutilized or underutilized resource, converting it into something of value that can then be consumed by other human beings. That is the nature of creating something out of nothing.

Now for the Paradox

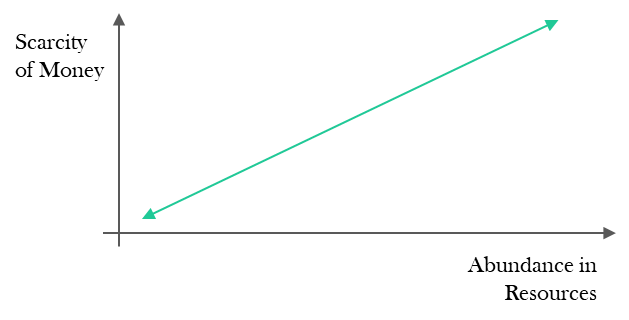

Abundance is created through scarcity. But, the paradox exists at two levels.

- If money is scarce, there will always be enough (for everyone). If money can be printed, there will never be enough (for anyone).

- Scarcity in money creates abundance in resources.

This paradox is puzzling to mainstream economists, most of whom believe the supply of money must be flexible (increasing or decreasing) to meet the needs of a changing economy. Bitcoin is finitely scarce, which makes it practically incompatible with the academic worldview of money. However, because bitcoin is finite, there will always be enough money to go around for everyone who adopts it–and to satisfy all needs within an ever-changing economy. Bitcoin can be divided into smaller and smaller units as more people demand it, which doesn’t diminish its scarcity (a phenomenon that often confuses people) but does ensure that bitcoin will always be as abundant as it needs to be.

Bitcoin stores purchasing power over time because of its finite scarcity–i.e., its ability to store value is tied to the fact that more units of the currency cannot be produced arbitrarily out of thin air. The nominal amount of money is not important. What is important is that the supply of money be reliably scarce and not susceptible to arbitrary change.

Isn’t it curious that in places like Venezuela, where money has become nominally abundant, real goods and services have become scarce. The more money you print, the more money you need. That is why–if money can be printed–any amount is never enough. More will simply be printed, requiring you to attain more in order to acquire the same good or service over time. And it is the printing of money that actually causes the availability of real goods and services to become scarce by impairing and impeding the ability of money to coordinate trade.

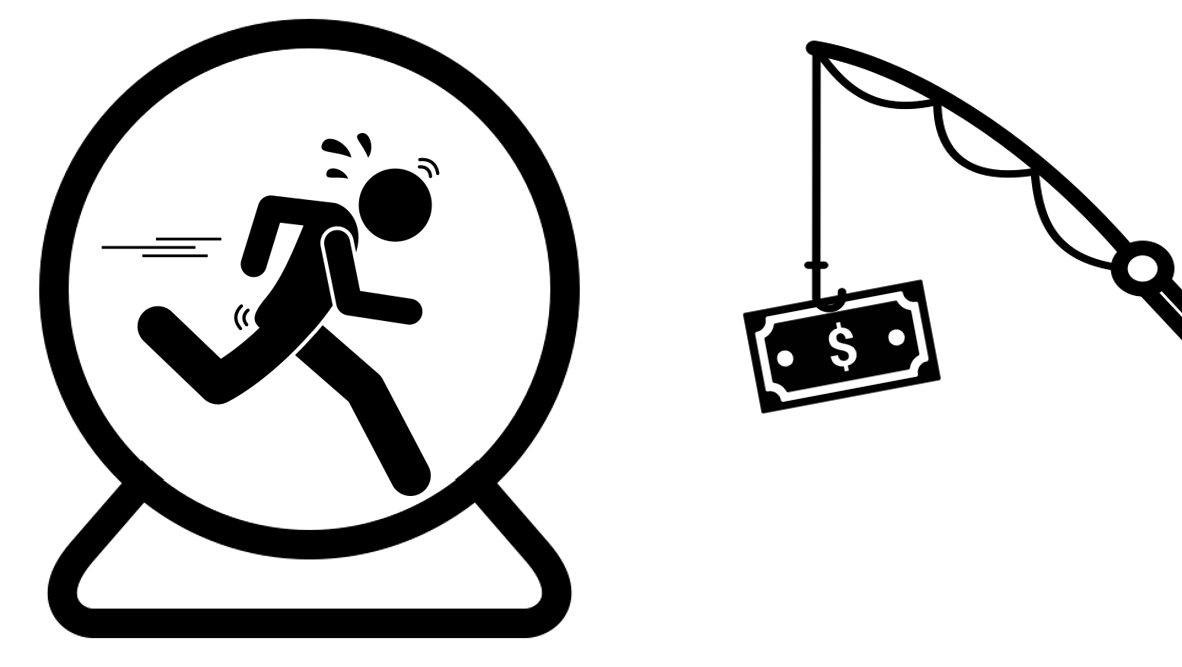

This is where the scarcity mindset interplays with those who endeavor to print money. The printing of money is rooted in the scarcity mindset. It is how the redistributionists surreptitiously redistribute the fixed pie of existing goods and services. As more people fixate on acquiring more money–because money is becoming more and more plentiful and each unit’s purchasing power degrades–less time is actually spent producing goods and services. People necessarily have to worry more about money. It’s perfectly rational.

If your money is losing its value, you have a more pressing need to focus more energy than you otherwise would on getting more units of a depreciating currency, which is not the same as producing value. More fundamentally, when money loses value (as it becomes more nominally abundant), two destructive economic forces become overwhelming: i) the incentive to produce value declines as the expectation of future purchasing power is destroyed and ii) money’s ability to coordinate trade becomes increasingly impaired because price signals are progressively distorted as more money is created.

When you take away the ability to print money, very positive economic forces take hold in the opposite direction. Any amount of money is enough because what’s “enough” is what stores value. Time as an input today better equates to the output of time in the future. Value delivered today holds purchasing power relative to value returned in the future. When you can’t print money, there is no arbitrary mechanism to diminish value created in the present, which is what allows any amount of money to be sufficient in preserving any amount of then-equivalent value. The preservation of purchasing power creates an incentive to produce value in the present, but the money itself–as a tool to more accurately price value–is also more reliable in coordinating trade (for the reason that it doesn’t change–i.e. can’t be printed). And trade is tangibly what creates greater abundance.

Importantly, a finitely scarce form of money becomes the tool through which those with an abundance mindset are empowered. It is the mechanism through which greater abundance is actually achieved–abundance through scarcity. The empirical evidence is everywhere. If wealth could be created by the printing of money, why not simply print to the optimal level. Why not print more and more and more? Why ever stop? And realistically, why is the printing of money observably followed by the destruction of wealth and the creation of greater scarcity? There must be a logical connection.

The Incentives of Scarcity in Money

The reliable scarcity of money is what creates greater abundance. It enables those with an abundance mindset to produce by providing the tool to first coordinate trade in the production of value and second, to then store surplus value (the excess value one produces for others vs. what is consumed from others) into the future–also known as savings. The ability for savings to store purchasing power into the future is part and parcel to the existence of an incentive to produce in the present.

That incentive is directly tied to the scarcity of money–which anchors money’s ability to maintain purchasing power. The existence of the incentive then produces more producers–i.e., more people with an abundance mindset. Scarce money empowers the individual, but it also creates more individuals with an abundance mindset. The societal pendulum begins to swing back in the broader direction of greater abundance. The incentive to save creates savers, and the incentive to produce creates producers.

Scarce Money → Incentive to Produce → More Producers → Greater Abundance

Scarcity of money creates an abundance in resources. It does so by better aligning the incentives to coordinate trade–the principal and direct activity money helps to facilitate. Scarce money incentivizes more trade (not less). As more trade occurs, more resources are utilized that would otherwise go to waste–simply by not being utilized. On an absolute basis, more of the world’s otherwise abundant resources are put into play. That is what creates wealth.

When nominally abundant, money becomes useless, and goods become scarce. When nominally scarce, money becomes functionally abundant as does the availability of real goods and services. It all starts and stops by empowering more people with a tangible tool and economic incentive to have an abundance mindset over one of scarcity.

Going into the New Year, realize that bitcoin is just a tool. Bitcoin by itself does not create value. It creates value by enabling individuals to produce and to maximally benefit from the output of labor. Think about what it means to have an abundance mindset–creating something from nothing and growing the abundance of resources. It is actually the mindset that creates the flywheel of greater abundance and that requires a shift in culture, which will be accelerated by the adoption of bitcoin. The cultural shift in mindset and bitcoin are related but both must be adopted intentionally. Embrace the paradox of bitcoin and scarcity. Abundance is created through scarcity–first in the cultural mindset and then in resources.

Happy New Year! Best, Parker

Final notes: If you or your business are interested in receiving bitcoin as payment, checkout Zaprite.com. We focus on business invoicing and ecommerce, enabling both non-custodial and custodial payments–lightning + onchain–plus we help you accept bitcoin side-by-side with fiat. I'm part of the team and we're here to help.

If you found this post valuable and interested to learn more about bitcoin, my book –Gradually, Then Suddenly: A Framework for Understanding Bitcoin as Money–is available for purchase exclusively at TheSaifHouse.com